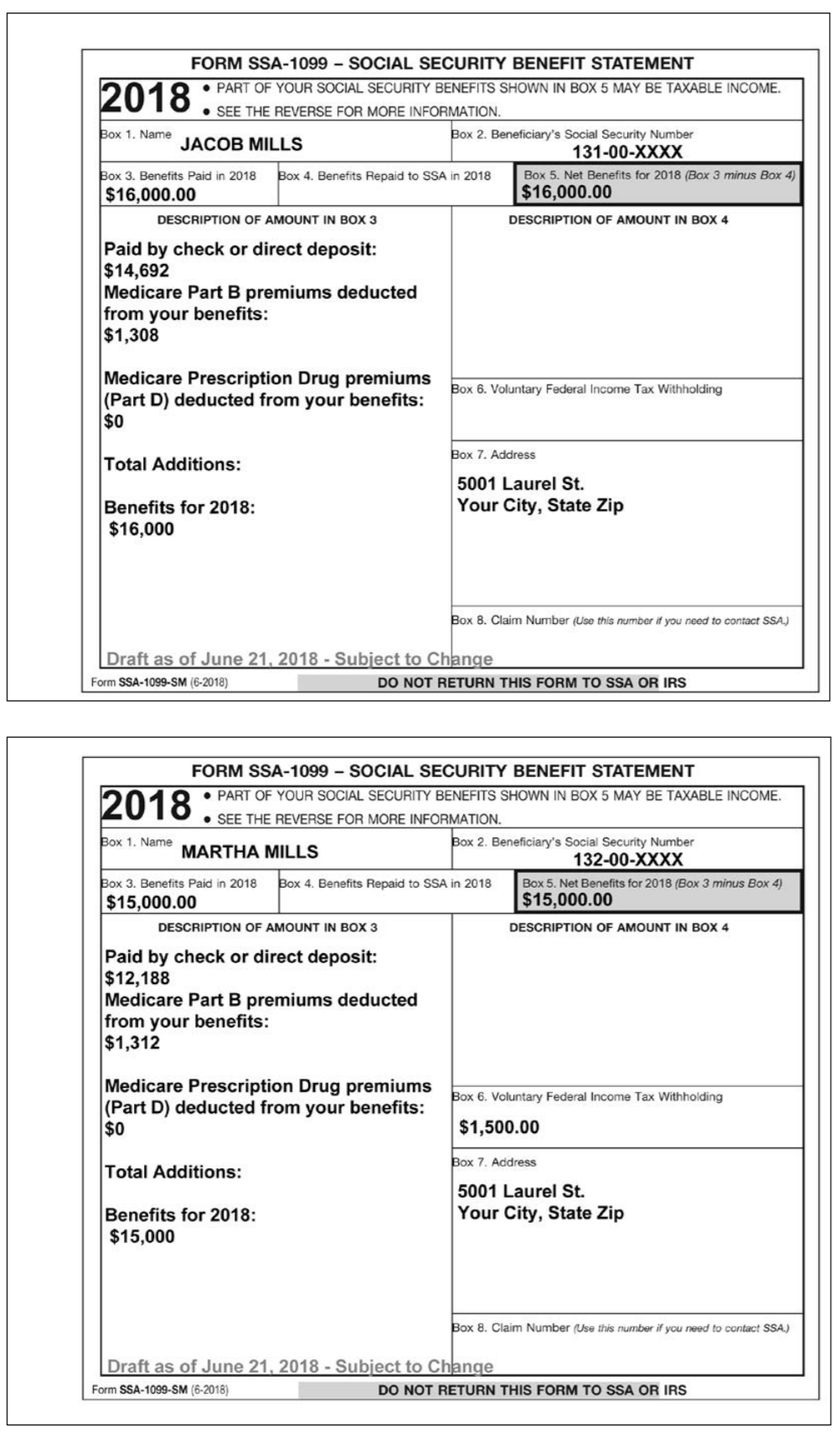

Discover learning games guided lessons and other interactive activities for children. Worksheet for Estimating the Taxable Portion of Your Social Security Benefit 1 Enter total annual Social Security SS benefit amount box 5 of any SSA-1099 and RRB-1099.

F709 Generic3 Lettering Worksheet Template Profit And Loss Statement

Many of those who receive Social Security retirement benefits will have to pay income tax on some or all of those payments.

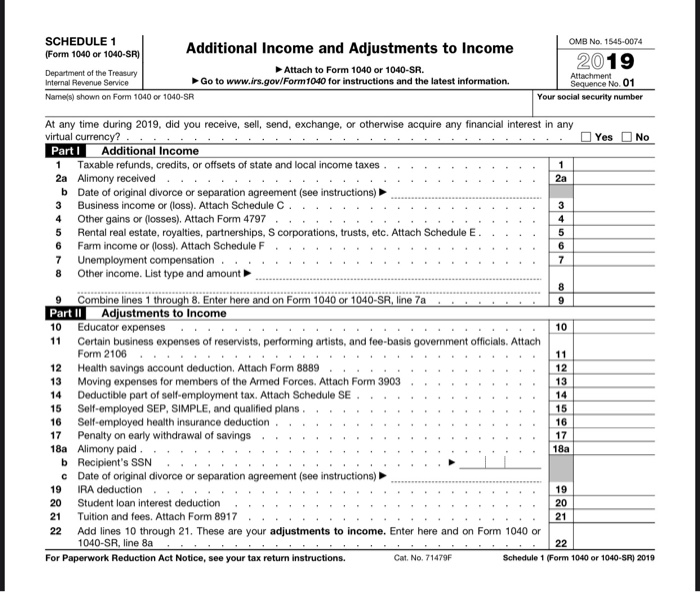

2019 social security taxable benefits worksheet. 2019 Social Security Taxable Benefits. Some states tax Social Security benefits as a piece of income but others dont or only tax some of your benefits. This calculator figures your taxable social security benefits based upon the IRSs 2019 Form 1040 2019 Schedule 1 and 2019 Publication 915 Worksheet 1 which was published January 10 2020 and made no substantive changes to the 2018 worksheet calculations.

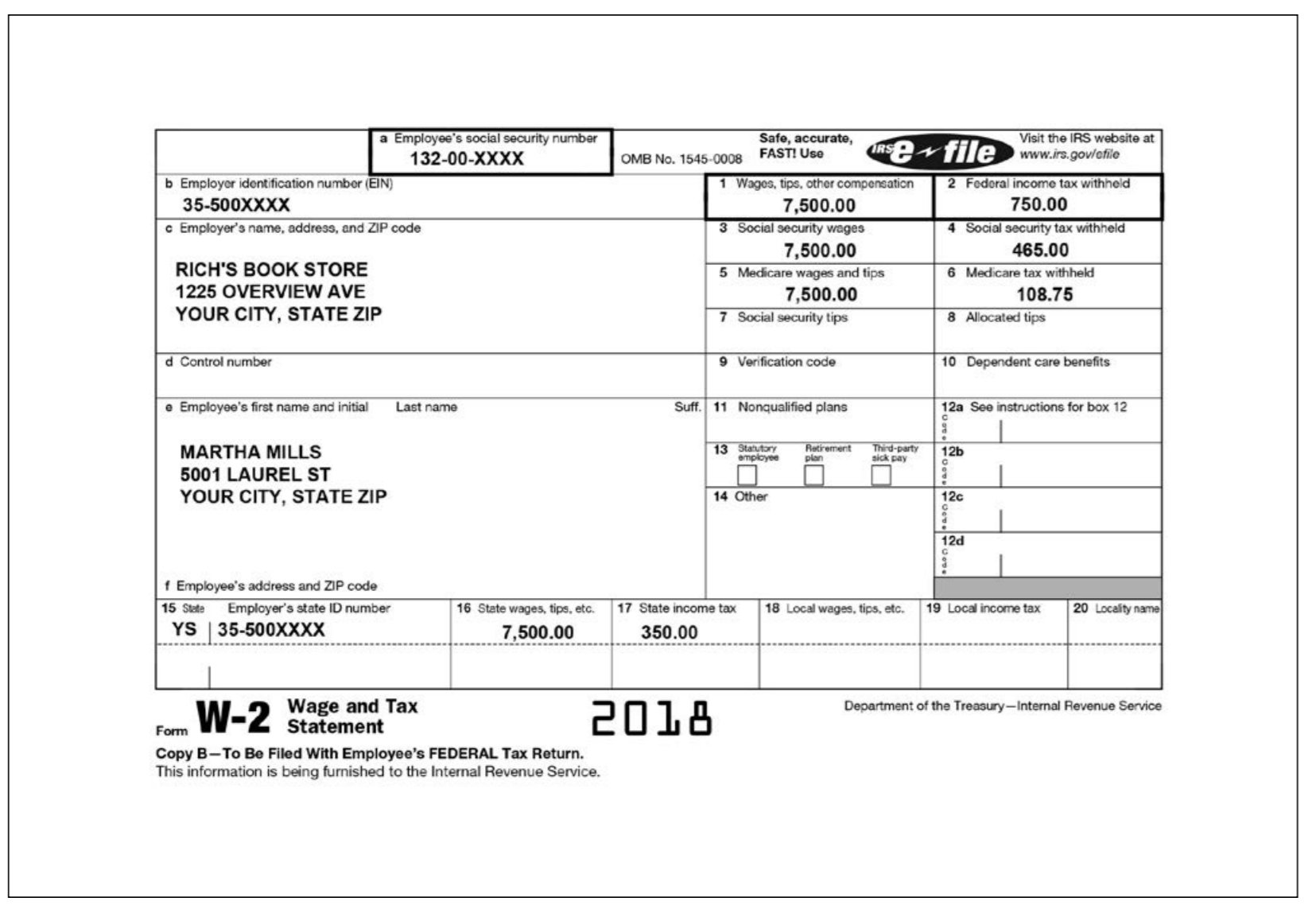

They complete Worksheet 1 shown below entering 29750 15500 14000 250 on line 3. On average this form takes 5 minutes to complete. Once completed you can sign your fillable form or send for signing.

Form 1040 Social Security Benefits Worksheet IRS 2018. Social Security Benefits Worksheet - Taxable Amount If your income is modest it is likely that none of your Social Security benefits are taxable. None of your social security benefits are taxable.

Do not use this worksheet if any of the following apply. 1 If the taxpayer made a 2019 traditional IRA contribution and was covered or spouse was covered by a qualified retirement plan see IRA Deduction and Taxable Social Security on Page 14-6. Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

Worksheet April 18 2019 1536. Instead go directly to IRS Pub. Also enter this amount on Form 1040 line 20b or Form 1040A line 14b If you received a lump-sum payment in 2016 that was for an earlier year also complete Worksheet 2 or 3 and Worksheet 4 to see if you can report a lower taxable benefit.

If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. If you are married filing separately and you lived apart from your spouse for all of 2018 be sure you entered D to the right of the word benefits on line 5a. If anyone is receiving social security benefits and he is receiving income from other sources too then it is possible that a portion of his income can be taxable.

Showing top 8 worksheets in the category - 2019 Social Security Taxable Benefits. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. We developed this worksheet for you to see if your benefits may be taxable for 2020.

More specifically if your total taxable income wages pensions interest dividends etc plus any tax-exempt income plus half of your Social Security benefits exceed. Subtract line 8 from line 7. Enter one-half of line 1.

Do not use the worksheet below if any of the following apply to you. You exclude income from sources outside the United. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

Social security benefits worksheet 2019 form social security benefit sheet 2018 line 5a and 5b Conclusion. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Discover learning games guided lessons and other interactive activities for children.

WK_SSBLD Names as shown on return Tax ID Number. Social Security Benefits Worksheet 2019 Caution. Some of the worksheets displayed are Notice 703 october 2019 33 of 117 2019 pension exclusion work Social security benefits work work 1 figuring Important information about tax withholding and railroad Social security benefits work figuring your taxable Social security.

Enter -0- on Form 1040 line 5b. You received Form RRB-1099 Form SSA-1042S or Form RRB-1042S. Worksheet instead of a publication to find out if any of your benefits are taxable.

The Form 1040 Social Security Benefits Worksheet IRS 2018 form is 1 page long. Worksheet to Figure Taxable Social Security Benefits. If you are concerned about a huge tax bill at the conclusion of the calendar year you can earn tax payments on your Social Security income throughout the year.

2 Enter one-half of SS benefits from line 1. 21 rows Calculator for 2019 IRS Publication 915 Worksheet 1. Do not use this worksheet if you repaid benefits in 2019 and your total repayments box 4 of Forms SSA-1099 and RRB-1099 were more than your gross benefits for.

Fill in lines A through E. As your gross income increases a higher percentage of your Social Security benefits become taxable up to a maximum of 85 of your total benefitsThe TaxAct program will automatically calculate the taxable amount of your Social Security income if any. If you are Married Filing separately and you lived apart from your spouse for all of 2019 enter D to the right of the word benefits on Form 1040 or 1040-SR line 5a.

Also enter this amount on Form 1040 line 20a. Available for PC iOS and Android. They find none of Rays social security benefits are taxable.

Start a free trial now to save yourself time and money. 915 Social Security and Equivalent Railroad Retirement Benefits. Enter the total amount from box 5 of all your Forms SSA1099 and.

All forms are printable and downloadable. Social Security Benefits Worksheet Before you begin. Social Security Benefits Worksheet 2019.

Ray and Alice have two savings accounts with a total of 250 in taxable interest income. Fill out securely sign print or email your 1040 social security worksheet 2014-2020 form instantly with SignNow. On Form 1040 they enter 5600 on line 6a and -0-.

3 Enter taxable income excluding SS benefits IRS Form 1040 lines 7 8a 8b 9-14 15b 16b 17-19. Enter the smaller of line 17 or line 18. Social Security Worksheet 2019.

Use Fill to complete blank online IRS pdf forms for free.

Basic Scenario 7 Jacob And Martha Mills Direction Chegg Com

Social Security Benefit Calculation Spreadsheet Spreadsheet Template Spreadsheet Excel Sheet

Social Security Benefit Calculation Spreadsheet Spreadsheet Social Security Benefits Social Security

Review Alexander Smith S Information And The W2 Chegg Com

Social Security Benefit Calculation Spreadsheet In 2021 Social Security Benefits Social Security Social Security Disability

Pin By Lance Burton On Unlock Payroll Template Money Template Money Worksheets

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Basic Scenario 7 Jacob And Martha Mills Direction Chegg Com

Social Security Benefit Ation Spreadsheet And Benefits Tax Worksheet Ator Then Calculation Counting Exercises For Kindergarten Year 1 Problems Base 10 1st Grade Math Practice Sheets Addition Graders Calamityjanetheshow

In A Comment Letter Sent June 13 2019 Roger Harris Expressed Concern That The New Requirements Placed On Employers P Federal Income Tax Lettering Employment

Social Security Benefit Calculation Spreadsheet Social Security Social Security Benefits Social

And To Adjust Your Irs Tax Withholding Bankrate Social Security Worksheet Calculator Math Word Problems For 5th Graders Preschool Morning Work The Budget Mom Printables 1st Pdf Simple Monthly Template Google Sheets

Form 1040 Is One Of Three Irs Tax Forms Used For Personal Federal Income Tax Returns Filed With The Internal Revenue Irs Tax Forms Irs Taxes Federal Income Tax

And To Adjust Your Irs Tax Withholding Bankrate Social Security Worksheet Calculator Math Word Problems For 5th Graders Preschool Morning Work The Budget Mom Printables 1st Pdf Simple Monthly Template Google Sheets

See The Eic Earned Income Credit Table Income Tax Return Income Federal Income Tax

Social Security Benefit Ation Spreadsheet And Benefits Tax Worksheet Ator Then Calculation Counting Exercises For Kindergarten Year 1 Problems Base 10 1st Grade Math Practice Sheets Addition Graders Calamityjanetheshow

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Iras Internal Revenue Servic Social Security Benefits Irs Tax Forms Tax Forms

No comments: